Finance-App

12

Finance-App APK helps you manage budgets, track expenses, invest, and make payments gain control of your finances from your Android device, anywhere.

Developer

TecKonzept GmbH

TecKonzept GmbH

Released on

2015-08-17T16:41:56+07:00

2015-08-17T16:41:56+07:00

Updated

May 10, 2025

May 10, 2025

Size

95.02 MB

95.02 MB

Version

12

12

Report this app

Images

Description

Unlocking Smarter Money Habits with Finance-App APK and Top Android Banking Apps

Finance-App APK is a financial application for Android that helps users manage their finances, track spending, invest, send payments, and stay updated on money matters right from their mobile device. If you’ve ever wondered whether you’re saving enough, spending too much on coffee, or could use a helping hand investing your spare change, this sort of personal finance management app is built for you. Finance apps offer a toolbox for anyone navigating today’s digital money jungle. As someone who’s tried more apps than workout routines, I can say these fintech tools transform daily money chores from boring tasks to quick taps. Let’s dig in because no one should need a PhD to follow their budget.Exploring Personal Finance Management, Payment Apps, and Investment Tools for Android

The universe of finance apps sweeps across everyone’s needs. Some people want to budget. Others want to invest, trade stocks, manage a portfolio, or just split dinner bills. Below, we break the types down into clear categories, revealing what each does best.Personal Finance Management

Personal finance management apps like Mint and YNAB (You Need A Budget) enable users to track income, expenses, and set budgets. The core idea is helping you see where your money goes and plan ahead. These apps connect to your bank accounts, categorize transactions, and highlight spending patterns. In my experience, seeing that doughnut habit in a pie chart is humbling, but useful.- Enjoy streamlined expense tracking: Automatic import and categorization keep you in the loop.

- Set financial goals: Save up for a trip, a gadget, or a rainy day fund all visible on a timeline.

- Analyze habits: Real-time charts and spending alerts help users make smarter decisions.

Banking and Payment Apps

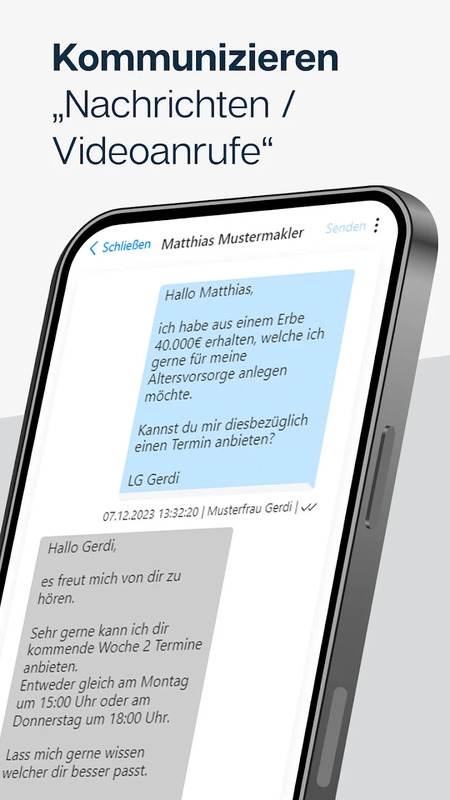

Banking and payment applications, such as Chase Mobile, Barclays Mobile Banking, PayPal, and Venmo, make banking portable and fast. No standing in lines or waiting for mailed statements. Unlike the stuffy bank experience of the past, a modern banking app lets you:- Send money to friends using just their phone number or email via payment apps like Venmo or PayPal.

- Check balances, pay bills, and transfer funds instantly.

- Deposit checks via your phone’s camera.

- Get real-time alerts about transactions or suspicious activity.

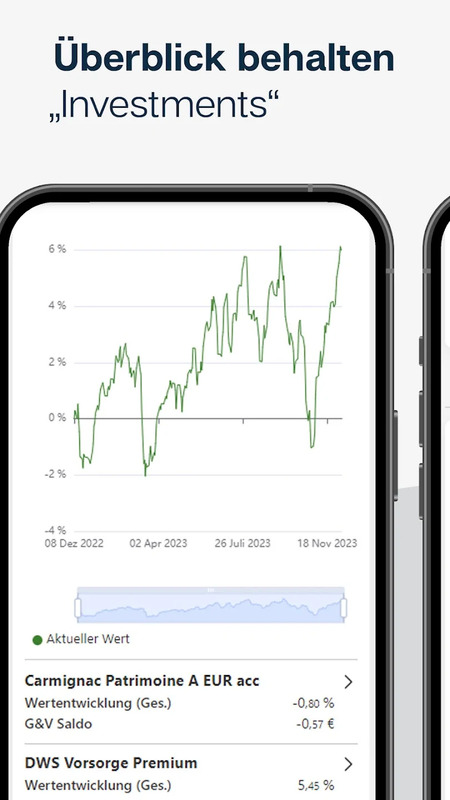

Investment and Wealth Management Apps

Want to invest in stocks, ETFs, or even crypto? Investment and wealth management apps such as Robinhood, Investing.com, Wealthfront, and Betterment bring these opportunities to your Android phone. The idea: anyone, not just finance pros, gets access to financial markets.- View real-time market data and updates, keeping a finger on ever-changing trends.

- Customize watchlists and track portfolios to stay organized with advanced portfolio management tools.

- Access investment tools: Many apps include tutorials, news, and even simulated trading for beginners.

Insurance and Financial News Apps

Managing insurance doesn’t have to mean endless paperwork. An insurance app like Geico Mobile or Allstate Mobile puts policy info and claim support right in your hand.- Review and manage policies at a glance.

- File claims and upload required documents instantly.

Essential Real-Time Updates and Security Features in Top Android Finance Apps

Finance apps stand out because of their focused features. Each tool, chart, or button is designed to help you act smarter with your money, whether you’re budgeting, trading, or paying your insurance premium.Real-Time Data and Updates

Access to current data matters in finance. Apps like Investing.com stream live market updates think real-time stock quotes, currency changes, and economic calendars. No secret, this freshness makes a difference:- React quickly: Being up-to-date lets you act on opportunities or risks before they slip away.

- Stay informed: Real-time notifications keep you alert to payments, bills, or changes in your portfolio.

Personalized Insights and Financial Tools

Modern finance apps don’t just show you numbers; they analyze your habits and guide you. Mint, YNAB, and Finimize are known for their ability to personalize tips, recommend savings, and uncover hidden trends.- Receive custom notifications: Get nudges if you’re close to blowing your budget or when rent is due.

- Build financial plans: Set up savings jars, investment goals, or retirement plans tailored to you.

- Automate savings: Some apps can round up spare change from purchases and invest it for you, turning small habits into big impacts.

Security and Cross-Platform Accessibility

Security is always a top concern. Quality finance apps offer multi-factor authentication, strict encryption, and other tools to keep your information safe. For example, Surf and similar development teams focus heavily on these protections. Additionally, using a cross-platform app means your progress never gets stuck on one device.- Multi-factor authentication: Prevents unauthorized access.

- End-to-end encryption: Keeps sensitive data away from prying eyes.

- Seamless cross-platform functionality: Switch between phone and tablet with no hiccups.

How Fintech Creators like SDK.finance, Railsware, and Dogtown Media Shape Android Banking Apps

Many finance apps are crafted by banks, fintech startups, and experienced software companies, all aiming to balance security with user-friendliness.Financial Institutions and Fintech Startups

Chase Bank, Barclays, NuBank, and Robinhood represent large banks and innovative fintech brands creating these digital tools. Their apps often blend everyday financial requirements with extras like personalized spending insights or AI-driven tips. Fintech brands like Robinhood and Intuit have shifted traditional finance by focusing on intuitive interfaces and value-added features. Their strengths include quick updates and learning resources.Specialized App Development Companies

Companies like SDK.finance, Railsware, Dogtown Media, Light IT Global, and Designli specialize in creating powerful finance platforms behind the scenes. Their projects range from banking tools to personal finance and investment platforms.- Known for integrating complex features real-time tracking, secure authentication, and scalable designs.

- Emphasize intuitive design, ensuring even dense finance tools feel navigable.

- Build for growth, so apps handle increasing user numbers or new regulations with ease.

Personal Finance Empowerment and Seamless Management with Android Investment Apps

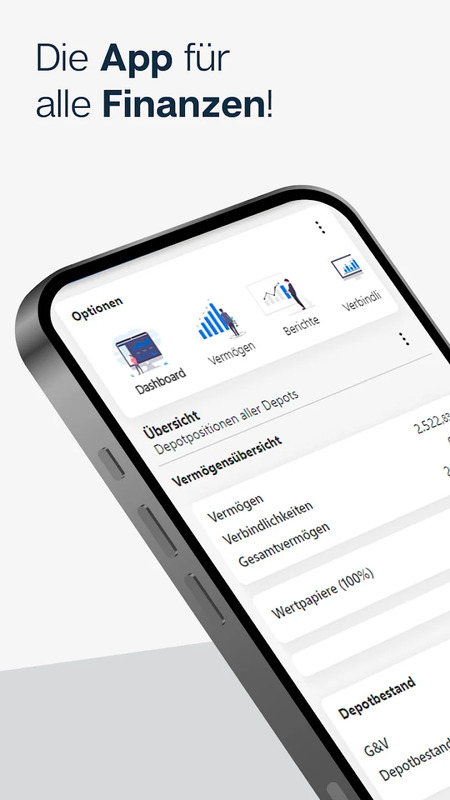

Why use a finance app? The real payoff is making life easier, more organized, and less stressful because everyone deserves a break from worrying about receipts and spreadsheets.Simplified and Accessible Financial Management

Managing money should not be a chore. These apps turn complex tasks into quick, simple actions.- Connect all accounts for a “big picture” view in seconds.

- Review spending, set reminders for bills, and even manage subscriptions.

- Get instant access to important financial information wherever you are.

Empowerment in Investment and Literacy

Finance apps enable users to make better investment decisions and improve financial literacy.- Access market knowledge: Get news, analysis, and recommendations tailored for all experience levels via financial news apps like Bloomberg.

- Experiment safely: Practice trading with demo accounts or follow experts through educational feeds.

- Grow confidence: Automated investing and transparent results help users develop smarter habits.

Future of Fintech: Real-Time Updates, AI, and Financial Inclusion in Android Apps

Finance apps continue to grow, sparked by technology and consumer demand. I watched habits shift in my own circle friends who never tracked expenses now check their account balances daily.Adoption of AI, Data Analytics, and Personalization

Apps are now using artificial intelligence and data analytics for sharper, more personal insights. Robinhood, Mint, and similar platforms use these tools to suggest strategies or identify risks before you notice them.- Adaptive interfaces: Custom dashboards that adjust based on your behavior.

- AI-powered alerts: Highlight unusual spending or investment opportunities.

- Improved advice: Recommendations grow smarter with every transaction added.

Expansion of Financial Inclusion and Technology

As mobile phones become more common, finance apps are reaching new audiences, from busy students to grandparents. Companies like NuBank and Barclays have embraced technology that lowers barriers.- Serve unbanked or underbanked individuals through mobile-first offerings on Android and other platforms.

- Web and Android support mean anyone with a smartphone can benefit.

- Enhanced accessibility features open financial tools to users with disabilities.